Asset Allocation

Proper Asset Allocation is Key to Successful Investing

Asset allocation is one of the most important determinants of investor success.

Renowned investing expert Roger Ibbotson identified that more than 100% of variability

of a fund's investment return is due to asset allocation. Participants who have

the opportunity to receive professional advice regarding appropriate asset allocation

and ten risk-calibrated index portfolios may significantly improve their odds of

investing success.

IFA’s research has demonstrated that proper asset allocation should be determined

based on 30 years or more of historical risk and return data, not a few years of

random noise or speculation about the future. Given this, an advisor who provides

ample data about style pure indexes may offer individuals a higher probability of

achieving their expected return, thus facilitating the very purpose of retirement

investing — income replacement. This knowledge diminishes the utility of a fund

line-up that consists of actively managed funds.

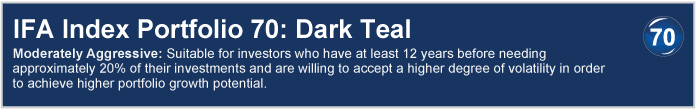

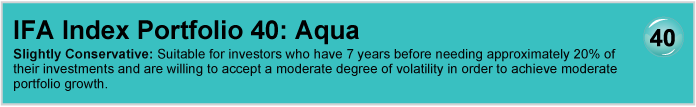

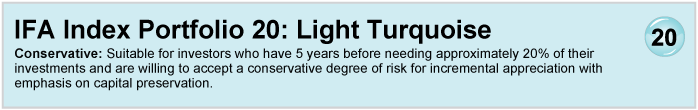

IFA’s 401(k) services provide ten risk-appropriate asset allocations suitable

for investors from very conservative to very aggressive and various levels of intermediate

risk. IFA’s asset allocation models are designed to capture specific risk exposures

over very long periods of time—investing science,

not pure speculation.

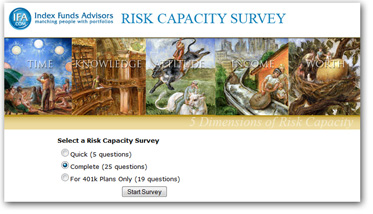

Click here to take the Risk Capacity Survey to find out which is the right portfolio

for you »