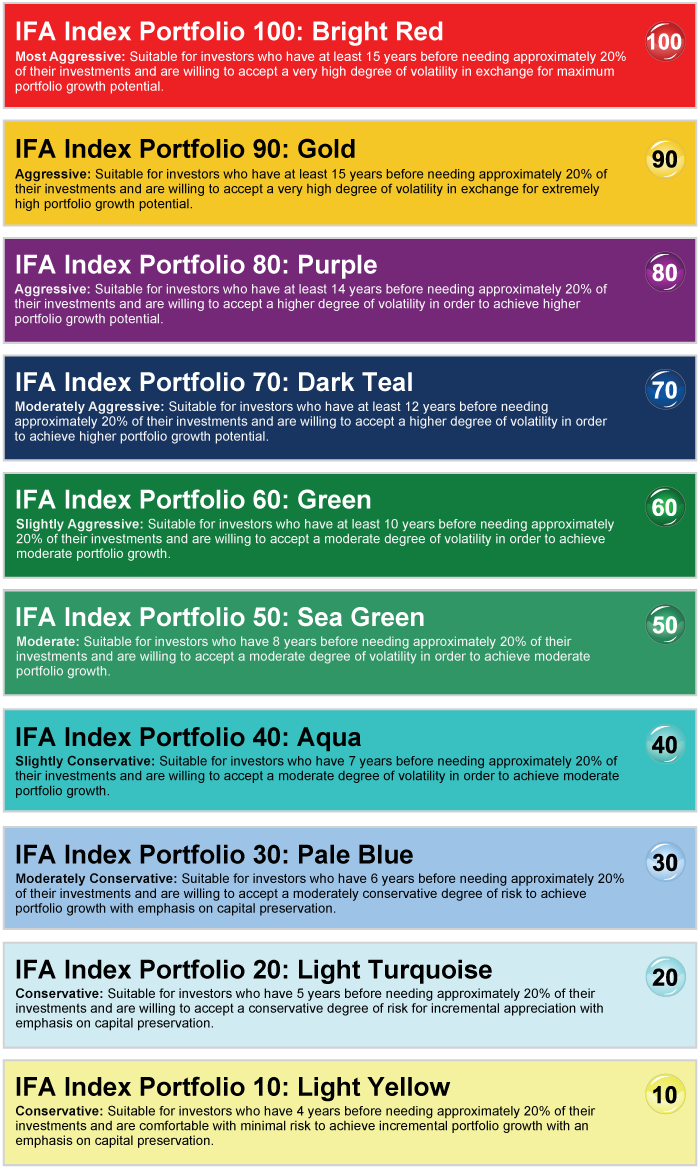

Matching People With Portfolios

IFA makes it simple for participants to choose an optimal portfolio

There is an intrinsic and beneficial relationship between risk, return, time, and

diversification. The table below describes the type of investor who would be appropriate

for each of the ten index portfolios available in your plan. Investors who are able

to take on more equity risk may achieve higher expected returns over time. For this

reason, it is IFA’s view that it is important to take as much risk as your risk

capacity allows. It is also important to make sure that you invest in accordance

with your risk capacity, as volatility leads to higher expected long-term returns,

but with higher short-term uncertainty.

(Please check with your plan sponsor to see which IFA Index Portfolios is offered

in your plan)

Easy Matchup

IFA’s 401(k) services provide ten pre-designed risk-appropriate asset allocations

suitable for investors from very conservative to very aggressive and various levels

of intermediate risk. IFA’s asset allocation models are designed to capture specific

risk exposures that have shown to reward investors over very long periods of time—investing

science, not pure speculation.

Survey

For those who want to take a simple survey to identify their investment portfolio,

there is a Risk Capacity Survey

on the site:

vWise

Video instruction is also offered through vWise, an online education program that

is customized to your plan — a value-added service IFA provides to ensure participant

understanding and satisfaction.

Click

here to view the interactive video for quick and easy 401(k) education and

planning, provided by IFA and vWise.

IFA provides plan-specific websites that serve as the main education and access

point for your company’s 401(k). This site contains all of the information for your

plan: easy account access, education, enrollment forms, and 24/7 login access to

your plan’s recordkeeper.

Still have questions? Your dedicated IFA advisor is just a call or click away, and

he or she will be pleased to help you choose the portfolio that’s right for

you.