Easy 401(k) Enrollment

Enrolling in the IFA 401(k) is Simple

IFA provides several access points to make enrolling in the plan and selecting the

right portfolio quick and painless.

IFA provides plan-specific websites that serve as the main education and access

point for your company’s 401(k). The plan site contains all of the information for

your plan: easy account access, education, enrollment forms, and 24/7 login access

to your plan’s record keeper.

Easy to complete investment selection forms make it simple for your participants

to choose an appropriate portfolio with an auto-rebalancing feature.

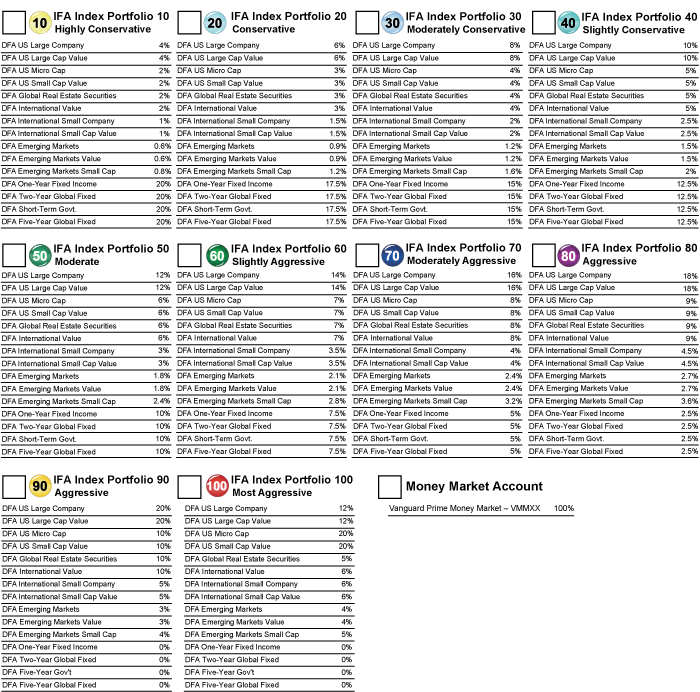

The table below shows the selection sheet for the IFA Index Portfolios. To view details of any portfolio, simply click on a colored, numbered button.

| Quick Guide to Index Portfolio Selection |

| Age Profile | Risk Profile | Index Portfolio

(Click to View) |

| Only High Risk Investors | Most Aggressive | |

| Only High Risk Investors | Aggressive | |

| Age 20 to 25 | Aggressive | |

| Age 30 to 35 | Moderately Aggressive | |

| Age 40 to 45 | Moderately Aggressive | |

| Age 50 to 55 | Moderate | |

| Age 60 to 65 | Moderately Conservative | |

| Age 70 to 75 | Moderately Conservative | |

| Only Low Risk Investors | Conservative | |

| Only Low Risk Investors | Risk Averse | |

IFA Offers A Simple Check-a-Box Portfolio Selection

Here is a sample of our portfolio selection form:

Survey

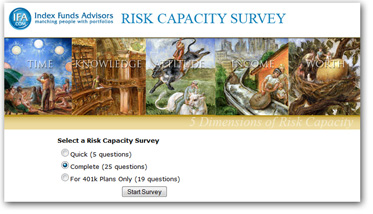

For those who want to take a simple survey to identify their investment portfolio,

there is a Risk Capacity Survey

on the site:

SmartPlan Advisor

Video instruction is also offered through vWise, an online education program which

is customized to your plan — a value-added service IFA provides to optimize participant

understanding and satisfaction.

IFA provides each plan with vWise’s state-of-the-art 401(k) information delivery

system: SmartPlan Advisor. This online interactive 401(k) information, education

and enrollment program is specifically designed to increase participation and improve

the investment outcomes for all plan participants.

SmartPlan Advisor enables each plan participant to go at their own pace in the privacy

of their home or office and carefully weigh and understand the investment options

available to them.

With Model Portfolio options designed to match an individual’s risk capacity, plan

participants will learn which Index Portfolio is appropriate for them, as well as

other information regarding how to plan to ensure their brightest retirement future.

Plan sponsors will benefit from the extensive information incorporated into the

SmartPlan Advisor platform. Drawing information from the plan document, SmartPlan

Advisor can answer many of the questions that participants may have about plan particulars.

This added benefit may save manyhours of human resources time repeatedly answering

the same questions. Additionally,, the SmartPlan Advisor platform may allow participants

to feel more educated regarding the retirement plan process, improving participation

and savings rates.

Still have questions? IFA is just a call or click away.